As a member of the military or a defense contractor, managing your taxes can be a complex and daunting task. The Defense Finance Accounting Service (DFAS) is a valuable resource that provides tax information and support to help you navigate the process. In this article, we will delve into the world of tax information with DFAS, exploring the services they offer, how to access your tax information, and tips for making the most of their resources.

What is DFAS?

The Defense Finance Accounting Service (DFAS) is a United States Department of Defense (DoD) agency responsible for providing financial and accounting services to the military and defense communities. One of the key services they offer is tax information and support, helping individuals and families to understand and manage their tax obligations.

Tax Information Services Offered by DFAS

DFAS provides a range of tax information services, including:

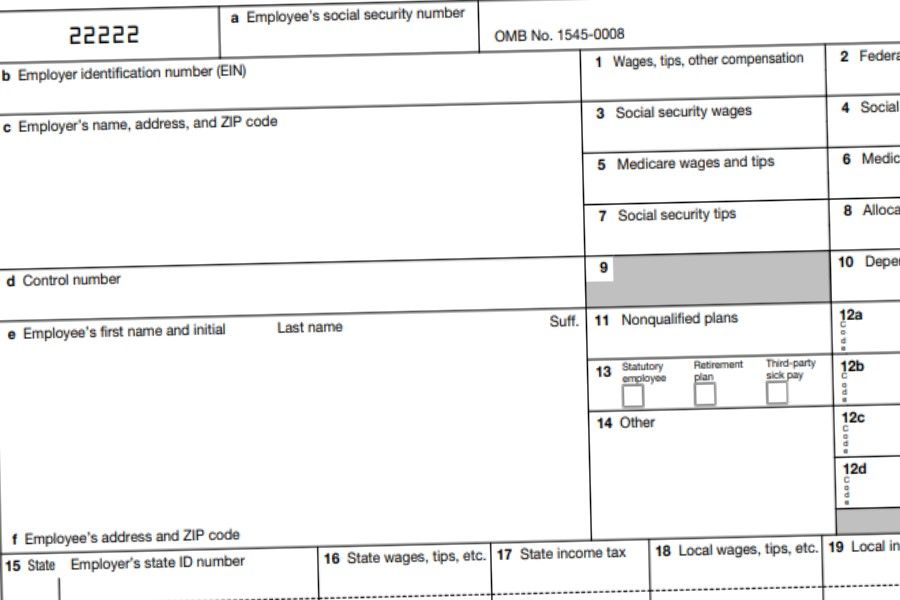

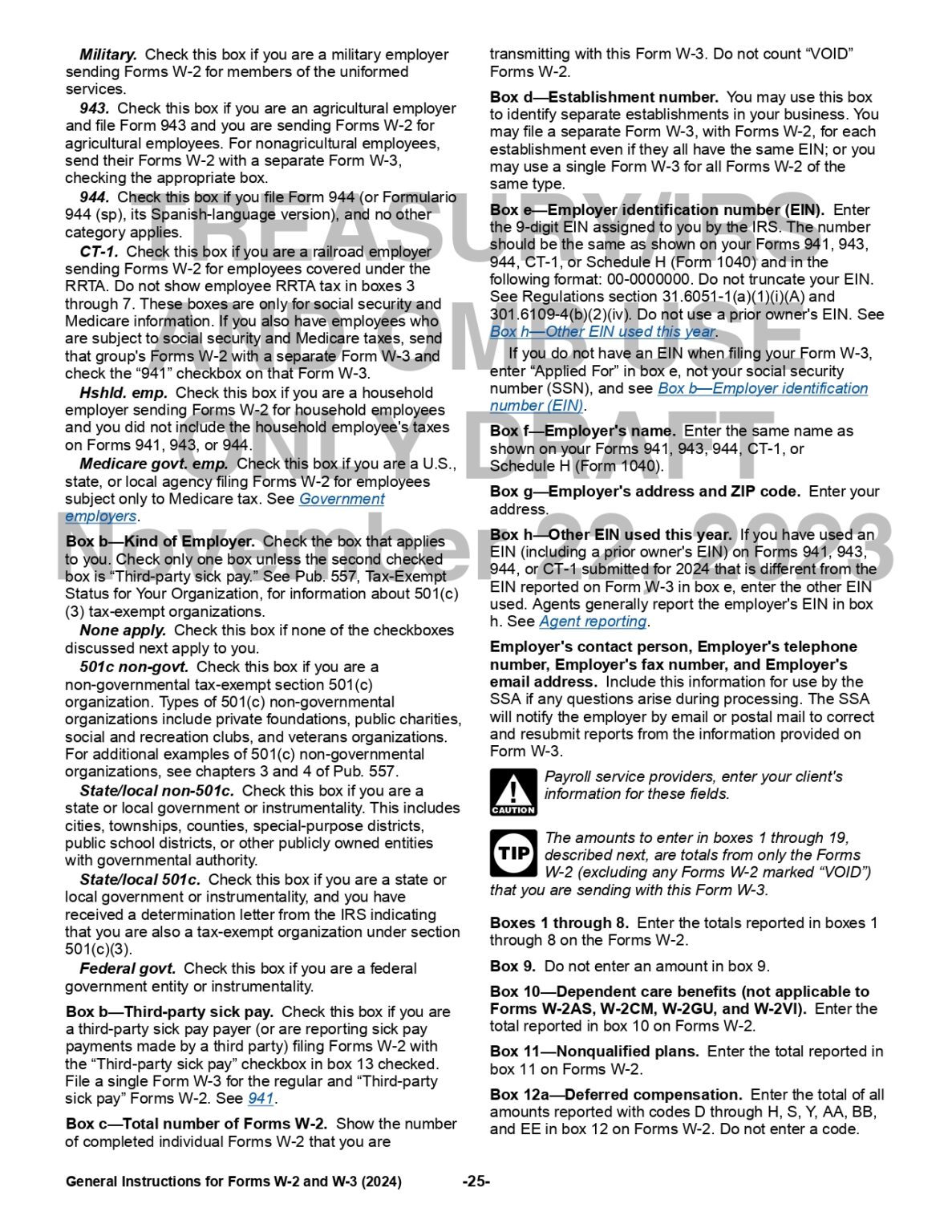

W-2 forms: DFAS generates W-2 forms for military personnel and defense contractors, which are available online through the

DFAS website.

Tax counseling: DFAS offers tax counseling services to help individuals understand their tax obligations and prepare their tax returns.

Tax preparation: DFAS provides tax preparation software and resources to help individuals prepare and file their tax returns.

Tax FAQs: The DFAS website features a comprehensive list of tax-related frequently asked questions (FAQs), covering topics such as tax filing, tax deductions, and tax credits.

Accessing Your Tax Information with DFAS

To access your tax information with DFAS, follow these steps:

1.

Visit the DFAS website: Go to the

DFAS website and click on the "Tax Information" tab.

2.

Log in to myPay: If you are a military personnel or defense contractor, log in to your

myPay account to access your W-2 form and other tax information.

3.

Contact DFAS: If you have questions or need assistance with your tax information, contact DFAS through their website or by phone.

Tips for Making the Most of DFAS Tax Information Services

To get the most out of DFAS tax information services, follow these tips:

Plan ahead: Start preparing for tax season early by gathering all necessary documents and information.

Take advantage of tax counseling: DFAS tax counseling services can help you understand your tax obligations and prepare your tax return.

Use tax preparation software: DFAS provides tax preparation software and resources to help you prepare and file your tax return.

Stay informed: Check the DFAS website regularly for updates on tax laws, regulations, and deadlines.

By understanding the tax information services offered by DFAS and following these tips, you can make the most of their resources and ensure a smooth and stress-free tax season. Remember to always plan ahead, take advantage of tax counseling, and stay informed to get the most out of DFAS tax information services.

![The Ultimate Guide to W2 Form PDF [2025]- WPS PDF Blog](https://res-academy.cache.wpscdn.com/images/seo_posts/20230612/f6f67eea04987633e8b456f6fea0aa7b.png)